Real Estate Investments

We look for value-add real estate investment opportunities and partnerships between $5 million and $50 million. We are quick, responsive, unfiltered, curious and open to all property types.

Single Tenant Office Building

In partnership, purchased a single tenant 8-storey 125k sf GLA building in Ottawa (December 2021)

Office to Multi-Family Conversion

In partnership, purchased and converting concrete 8-storey office tower with 210k sf GLA on 9.40 acres of contiguous land into a premium 219-unit purpose-built multi-family rental property in Ottawa (December 2021)

Class A Modern Distribution Facility

In partnership, purchased a 252k square foot stand-alone Class A modern distribution facility in southeast Edmonton (April 2022).

Highway-Facing Manufacturing and Distribution Facility

In partnership, purchased a highway-fronting 246k square foot manufacturing and distribution facility on 12 acres in a sale-leaseback in the Greater Toronto Area (February 2023).

Multi-Tenant Industrial Building

In partnership, purchased a 120k sf building adjacent to the Niagara Escarpment in Hamilton, Ontario (October 2020).

Small Bay Industrial Portfolio

In partnership, purchased a portfolio of ten institutionally owned small-bay industrial properties comprising 349k sf in Edmonton, Alberta (January 2020).

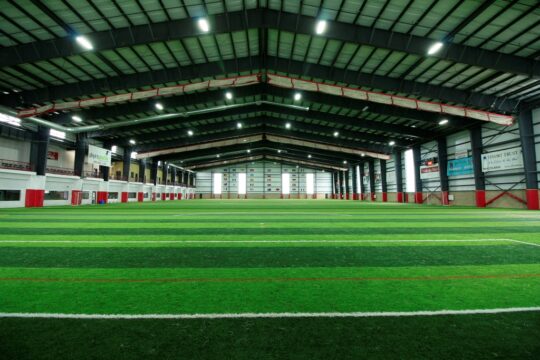

Single-Tenant Industrial Building

In partnership, purchased a 98k sf single-tenant industrial/recreational building in Hamilton, Ontario (December 2018).

Forgestone Mortgage Fund LP/GP Launch

Forgestone Mortgage Fund LP is a Canadian commercial mortgage lender participating in all major markets from coast to coast. Forgestone provides flexible, creative and collaborative lending solutions by forming financial partnerships and building strong relationships with borrowers and mortgage brokers. Crux is a General Partner and LP Investor, and Peter is a member of the Investment Committee (September 2018).

Multi-Family Residential Development

In partnership, developing a 54-unit, 6-storey condo development in Vancouver, British Columbia (April 2018)

Multi-Family Residential Development

In partnership, developing a three-phase multi-family development in Montreal, Quebec (February 2018). First tower of 139 units completed in 2022.

New Generation Industrial Building

In partnership, purchased 370k sf modern industrial building in Oshawa, Ontario (January 2018).

Commercial and Multi-Family Residential Development

In partnership, developing a 55k sf site for commercial use and multi-family residences in Vancouver, British Columbia (November 2017).

Mixed-Use Industrial and Flex Office Building

In partnership, purchased a 74k sf mixed use industrial and flex office building on 6.45 acres of land in Ottawa, Ontario (November 2017).

Granite Real Estate Investment Trust

Crux Capital and Peter Aghar participated in a successful shareholder activism (June 2017), which helped unleash Granite REITS’s true value and potential (GRT.UN unit price has since more than doubled, as has its enterprise value). Peter is a member of the Board and Chair of the Investment Committee.

Manufacturing Facility

In partnership, purchased a 225k sf single-tenant manufacturing facility in Calgary, Alberta (December 2016).

Industrial Redevelopment

In partnership, provided a convertible loan to purchase a 400k sf industrial redevelopment site in Hamilton, Ontario (December 2016).

Mixed Use Urban Development

Minor partner in a redevelopment of a manufacturing facility into a 959k sf mixed-use urban residential, community and commercial centre in Toronto, Ontario (August 2016).

Single-Tenant Industrial Building

Purchased a 171k sf single-tenant industrial building in Drummondville, Quebec (October 2016).

Mixed Use Commercial

In partnership, purchased and redesigned a 226k sf mixed-use commercial building in Toronto, Ontario (April 2016).

Multi-Tenant Distribution Facilities

In partnership, purchased a 456k sf business centre in Woodstock, Ontario (September 2015).

Student Residence and Culinary Arts Centre

In partnership, supported development of a 347k sf LEED Silver Certified centre for university students in the Greater Toronto Area, Ontario (March 2015).

PRO Real Estate Investment Trust Relaunch (PRV.un)

Crux Capital and partner Lotus Capital were the lead investors in a public offering and relaunch of PRO REIT, which has grown in assets from $70M in early 2014 to $1B in 2022.

Convertible Land Loan

In partnership, provided a convertible land loan to develop an 830k sf site in London, Ontario (July 2014).

Multi-Tenant Modern Warehouse

In partnership, purchased a 292k sf mixed-use warehouse in Whitby, Ontario (January 2014).

Modern Distribution Facility

In partnership, purchased a 401k sf building in Sacramento, California (November 2013).

Grocery and Drug Anchored Retail Centre

In partnership, purchased a 126k sf retail centre in Kitchener, Ontario (November 2013).

Some of our Partners: